After a long drive back from California I had the chance tonight to listen to the 2022 Q3 Tesla earnings call. Like I have done with previous earnings calls, I have compiled notes that I wanted to share below. Enjoy!

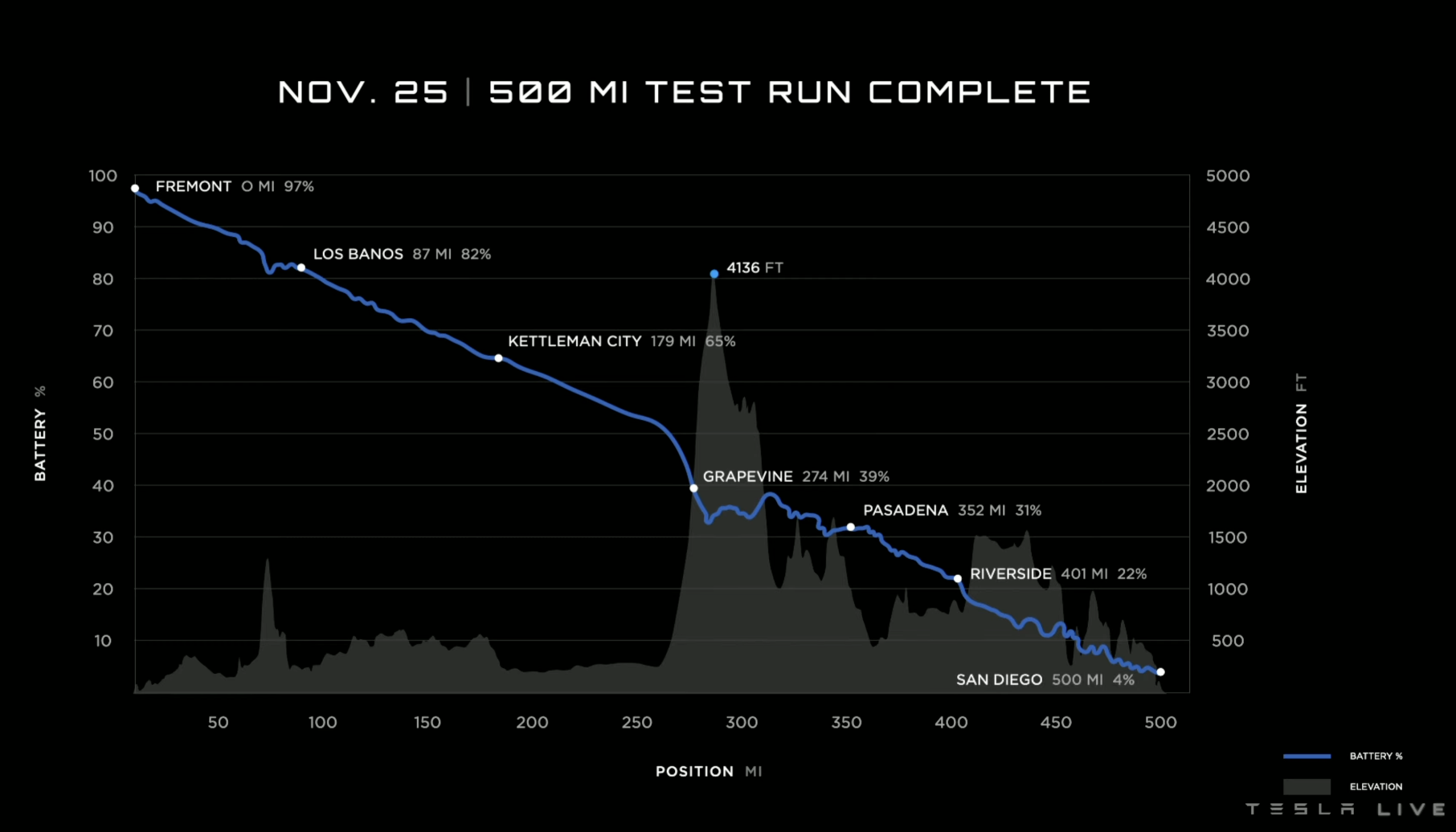

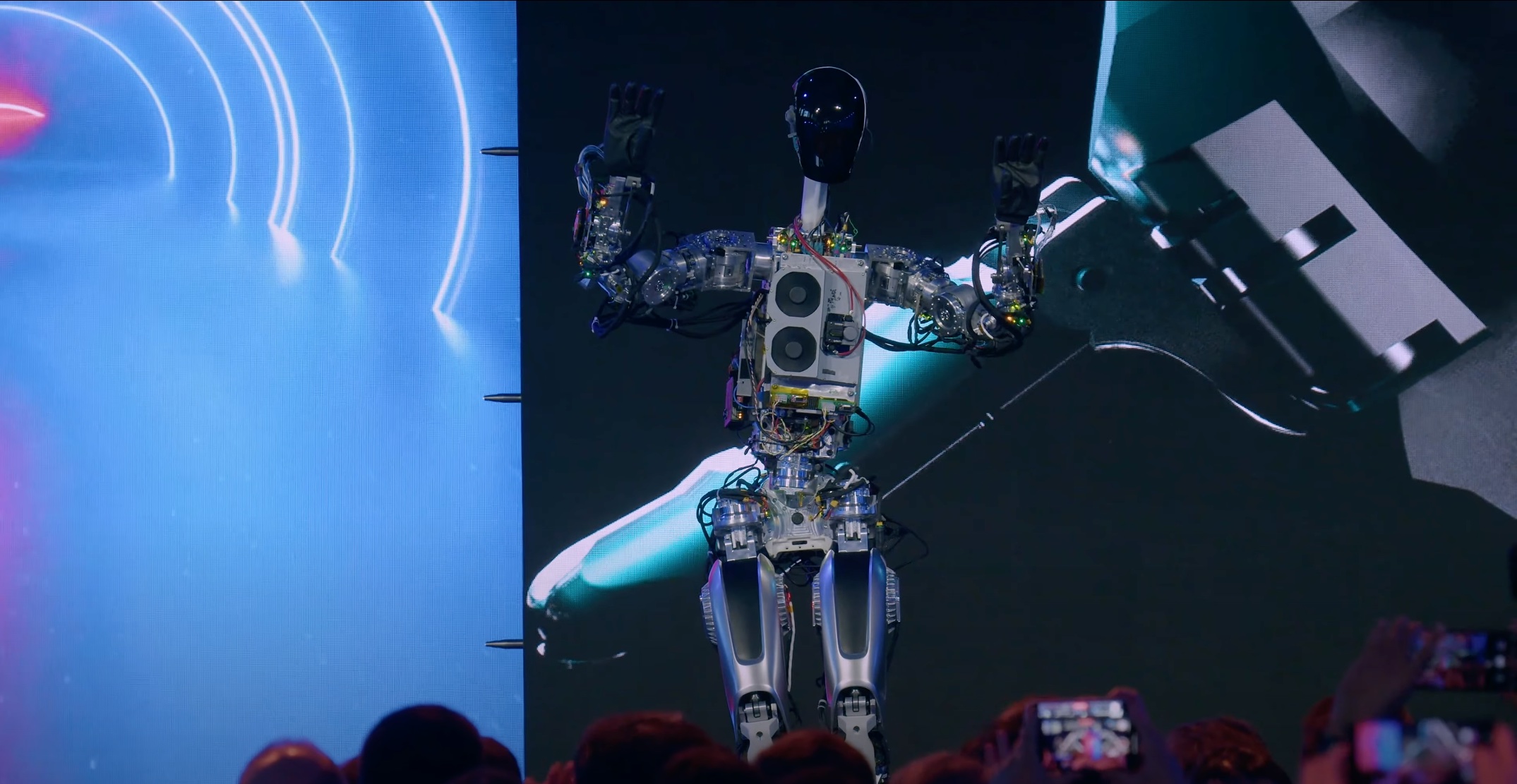

Opening remarks from Elon Musk General Q3 record quarter on many levels Industry leading operating margins of 17% Free cash flows surpassed $3B in Q3, $9B over last 12 mos Q4 should be record breaking and tracking well so far Giga Berlin reached milestone of 2000 cars per week (with very good quality), continues to rapidly ramp Giga Texas should reach milestone of 2000 cars per week very soon Demand continues to be strong especially for Q4 and Tesla expects to to sell every car they make for the foreseeable future “Long way to go to reach 1% of global vehicle fleet” -Elon Musk Stock buyback completely possible even with worst case scenario but still needs to go through formal board review Long term trend for Tesla continues to be positive Elon for the first time recognizes that Tesla has the potential to be larger than Apple & Saudi Aramco combined (without factoring in Optimus) “Most exciting product portfolio on earth, some of which you have hard of and some which you haven’t” -Elon Musk Final development stage for CyberTruck with production equipment being set up Robotaxi platform design coming along nicely Moving as fast as possible to achieve 1TWh of vertically-integrated battery production capacity in the US (including anode, cathode, lithium refining, etc.) 4680s 4680 production has tripled in Q3 compared to Q2 Elon expects 4680s to be a significant portion of vehicle production in Giga Texas in the near future 2nd generation of manufacturing equipment for 4680s in Giga Texas continues to quickly ramp and will nicely compliment the existing Kato Rd Battery Pilot Plant AI Day 2022 Follow Up Recruiting goal accomplished as smartest AI folks are applying and considering careers w/ Tesla Autopilot 60M millions driven by FSD Beta as of September 2022 FSD Beta to move to wide release to all North American customers by end of 2022 (current target is November) Anybody that has ordered FSD Beta (or subscribed) will have immediate access to FSD Beta Tesla is seeing that safety increases with vehicles w/ FSD Beta enabled than those that don’t Opening remarks from Zach Kirkhorn Automotive Profitability GAAP: 17.2% Gross: 27.9% Operating margin best yet even with Giga Berlin & Giga Texas production ramps weighing heavily With Giga Berlin, Giga Texas, and regulatory credits excluded, operating margins would have been strongest yet and gross margin would have been ~30% With that said, Giga Berlin & Giga Texas are positively contributing to future profitability as they ramp further & further Margin headwinds associated w/ macro economic conditions Energy gross profits highest they have been thanks to record production of Megapack & Powerwall offerings Free cash flows record despite decrease of cars in transit at end of quarter Started to experience limits on outbound logistics capacity which was not anticipated Definitely recognized with cargo ships leaving China as well as trucks within Europe Previously, roughly 2/3 of Q3 deliveries occurred in month of September with 1/3 of those coming in the final two weeks As a result, Tesla has begun to spread regional builds throughout the quarter to reduce transportation & logistic bottleneck (should also reduce costs, improve customer experience, etc). Still on track for 50% annual growth in production in 2022 however some supply chain risks exist (out of Tesla control) 50% annual growth for deliveries will be just below due to increase in cars in transit Expect a gap in production & delivery numbers in Q4 however those vehicles will be delivered at the beginning of Q1 2023 Continuing to build cars as fast as possible while maintaining healthy operating margins Q & A Inflation Reduction Act (IRA) Tesla plans to fully meet IRA’s requirements and sees it as a big accelerator for Tesla achieving their mission as well as battery supply chains here in America Elon meets they will meet all thresholds outlined in the IRA Worldwide Backlog (outside of North American) Elon believes China is experiencing a recession of shorts (property market) while Europe has a energy-driven recession New Products “Tesla is committed to continuous improvement” -Elon “Best Tesla is the latest Tesla” -Elon Musk “Plaid Model S & X are the best cars on earth, nothing close, just try one” -Elon Giga Berlin & Possible Power Cuts in Germany Don’t foresee this as a large risk to the company Cast front underbody as well as structural battery pack (Model Y) will be introduced to Giga Berlin later this year CyberTruck Facilities are actively being prepared for CyberTruck production On track for early production in early 2023 Beta builds have started and will continue to ramp into 2023 “When can I drive my beta” -Elon Musk Elon blamed delay on force majeurs including global supply chain crisis Tesla Semi First deliveries to Pepsi Co December 1st, Elon will be attending in person Will initially ship with the 2170 battery cells and eventually 500 miles of range (on level ground) fully loaded w/ cargo “I’d ask, what are your assumptions about wh/kg and wh/mi and they’d look at me with a blank stare, and say Hydrogen” -Elon Elon believes hydrogen is not needed for heavy duty trucking Takes a year to ramp production so expectation is to significantly ramp over next few years w/ production target of 50,000 units in North America by end of 2024 Plan is to expand Tesla Semi beyond North American Batteries 4680 production is expected to exceed 1000 car sets / week by end of Q4 2022 Focus is now shifting from production ramp to cost optimization and increasing production capacity in North America 300-400TWh of battery production necessary to transition entire world to sustainable energy Main cathode material will be iron since it can scale to very high tonnage 2x as much iron as nickel Manganese mixed in as well Aggressively pursuing a North American cathode supply, more to come on this one Tesla still believes they will meet the estimates they outlined on Battery Day Drew has been daily driving a structural pack Model Y for some time, still going strong Prolonged Recession Not reducing production in anyway, recession or not Elon believes Tesla is recession resilient (not recession proof) thanks to the fact the world has acknowledged they should move to EVs Battery storage needed to realize larger rollout of renewables Growth of energy storage business unit expected to grow at a rate of 150-200% per year, faster than vehicles by a lot Tesla can withstand quite a bit of downside before having to tweak production, product roadmap, etc. Even if 2023 is a horrible recession year, they still foresee generating noticeable amounts of cash Primary focus of new vehicle development team is to create next generation vehicle Half the cost of the Model 3 & Y platform Will be smaller as well Will quickly exceed the production of all other vehicles combined Going to take everything they learned from other vehicles into next-gen vehicle Goal is to create 2 cars with the same effort it takes to build a single Model 3 Vertical Integration Only have done this out of necessity and if it is required for them to do mining, Tesla will do it Elon has been meeting with senior US govt officials and he has asked for them to expedite permitting process for clean energy related projects Gradual improvements as they redesign the whole supply chains, Tesla is figuring out dramatic inefficiencies FSD Beta Elon expects functionality to be good enough to take you from your house to a friend’s house, grocery store, etc. “Almost never should have to touch the controls” -Elon Elon believes next year they’ll have sufficient data to share w/ regulators that proves FSD Beta is safer than the average human driver Operational efficiency Many different areas that Tesla can optimize further Costs of many commodities coming down however key elements like Lithium remain high Shipping costs went from $20k per container to about $3.5k (lots of things have been deflationary) Twitter Elon is excited even though he and partnered investors are over paying for Twitter He believes long term value far exceeds that of its current value Dojo Still a debate on whether or not it’ll be able to exceed performance of latest & greatest NVIDIA GPUs when it comes to NN training Elon believes they’ll known within next 1 - 1.5 years if Dojo is more powerful than NVIDIA GPUs